By Agroempresario.com

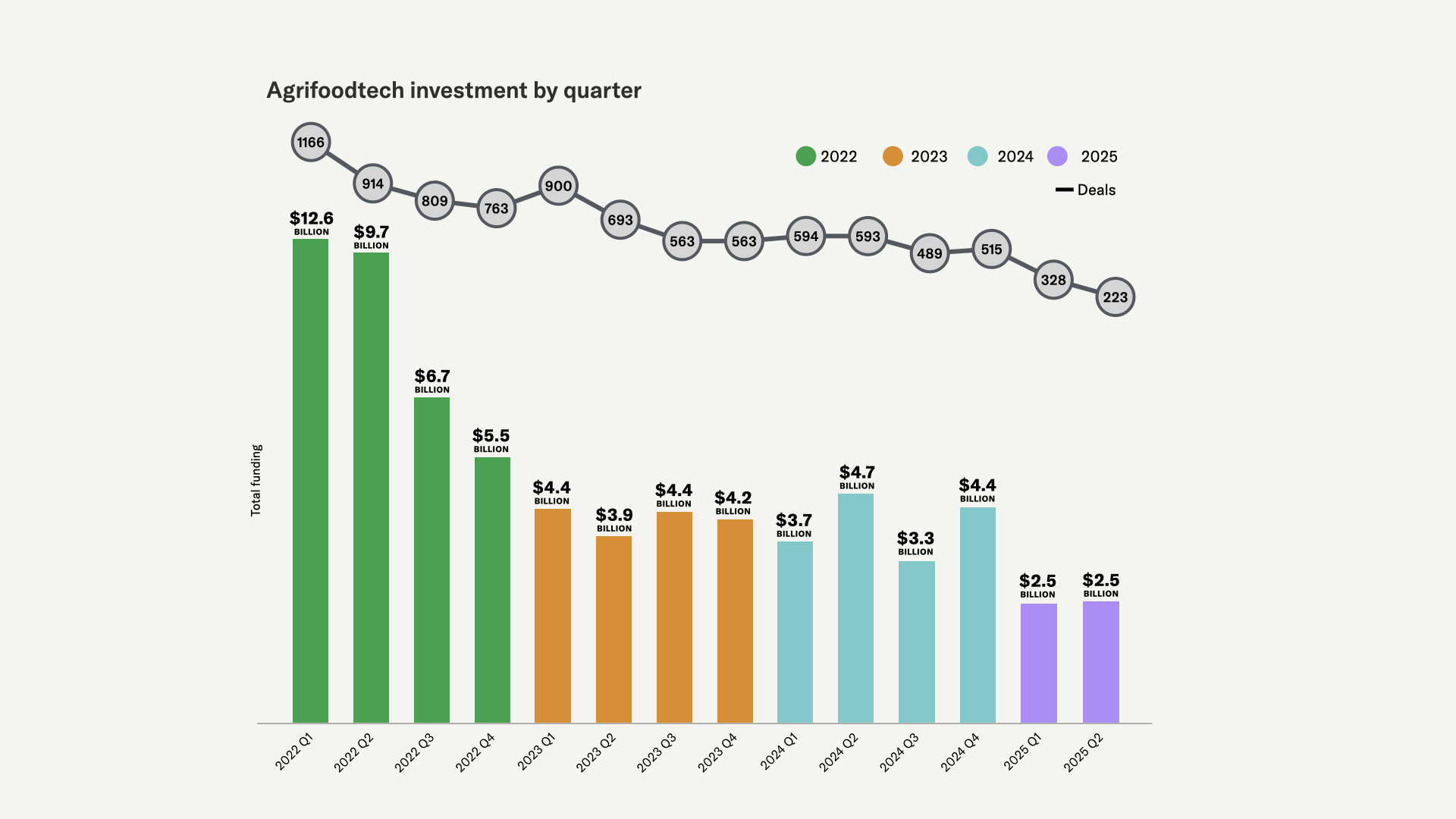

Venture capital (VC) funding for agrifoodtech startups has dropped sharply in the first half of 2025, marking the lowest H1 investment in the sector since 2015. According to preliminary data from AgFunder, total funding reached just $5.1 billion across 551 deals, representing a 37% drop compared to the $8.1 billion across 1,187 deals recorded during the same period in 2024.

Despite this dramatic decline, many industry leaders view this downturn not as a death knell but as a typical bottoming signal, marking the emergence of new strategic opportunities for investors and founders alike.

Agrifoodtech funding surged during the past decade, peaking in the pandemic-driven years of 2020–2021, when remote work, digitalization, and supply chain disruptions fueled investor enthusiasm. The sector appeared resilient, innovative, and necessary. But since then, the story has changed.

“For about eight years, from 2013 to 2021, we saw the gentrification of foodtech and agtech,” explains Rob LeClerc, founding partner at AgFunder. “Now we’re seeing a VC flight out of everything not AI.”

Indeed, AI startups raised over $100 billion in 2024, absorbing nearly a third of all venture capital globally. The broader economic environment—defined by geopolitical tensions, inflation, and economic instability—has not helped either.

With capital being deployed more cautiously, investors are showing a clear preference for focused, efficient, and locally adaptive startups. Darren Leong, principal at Clay Capital, emphasizes the importance of regional market understanding.

“Categories that struggled in one region are gaining traction in another,” says Leong. “We’re seeing founders build leaner teams, concentrating on a few core products, and proving market-fit before scaling.”

Mark Kahn, managing partner at Omnivore, echoes this sentiment. He notes strong investor interest in agri-fintech, full-stack contract development and manufacturing organizations (CDMOs), and sustainable materials.

“Capital is leaning toward models that clearly drive efficiency and scale,” Kahn explains. “There’s growing confidence in breakthrough sectors like agrifood life sciences.”

As investors pivot toward sectors with strong scientific foundations, life sciences and biology experts are replacing generalist VCs in agrifoodtech.

Antony Yousefian, partner at TheFirstThirty VC, highlights this transition:

“The wider restructuring is mostly complete. Vertical farming, alt proteins, and now carbon startups have fallen. That’s a bottom signal. These are exactly the times to invest.”

Yousefian is not alone in this view. Many believe the worst is over, and that the current environment is ripe for disciplined, mission-driven startups to gain momentum.

Though overall investment fell, several notable deals shaped the funding landscape in H1 2025:

Meanwhile, Ag Biotech, the top-funded category in H1 2024, dropped to fourth place. Only Inari, a US-based seed design company, reached a nine-figure round in 2025. Other startups in the category raised less than $30 million each.

Farm Robotics and Mechanization also slipped:

Innovative Food, another high-flier during the peak years, saw investment fall from $828 million in H1 2024 to just $250 million this year. Similarly, Novel Farming Systems dropped from $336 million to $144 million over the same period.

These numbers reflect not only lower investor appetite but also the natural attrition of overhyped categories and a return to fundamentals.

If 2020 was about disruption and 2021 about growth-at-all-costs, 2025 seems to be the year of strategic resilience. Founders who survived the turbulence of the past two years are more disciplined, more focused, and more aware of how to deliver measurable outcomes.

“There’s a flight to quality,” says Leong. “Investors are backing founders who can build real businesses, not just flashy decks.”

This means a shift from expansive, scattershot growth to measured, regional scaling and capital efficiency. The emerging agrifoodtech leaders are proving their models in initial markets, establishing operational resilience, and offering clear paths to profitability.

Though the headline figures paint a bleak picture, experts suggest this is a reset—not a retreat. The data indicates a bottoming out, and in many ways, the sector is now better positioned for long-term growth.

“The generalists have exited, and the tourists are gone,” notes Yousefian. “What’s left are domain experts, long-term thinkers, and operators who understand food, agriculture, and science.”

If historical cycles hold, this phase of capital scarcity and disciplined innovation may lay the groundwork for the next wave of success in agrifoodtech. With a sharper focus, more realistic valuations, and an emphasis on science-driven solutions, the industry is quietly preparing for its next leap forward.

As Kahn puts it, “This isn’t the end—it’s the opportunity.”