Global demand for seafood is set to soar in the coming years, with some predicting it will more than double by 2050 as the population grows and trade changes, and as protein becomes more affordable to more consumers. Meeting that demand will require multiple different approaches, especially those that can deliver on demand without further taxing already depleted fishstocks and damaging marine ecosystems. A mix of wild-caught fish and seafood, aquaculture operations, and plant-based and cultivated analogues could significantly boost global protein supply.

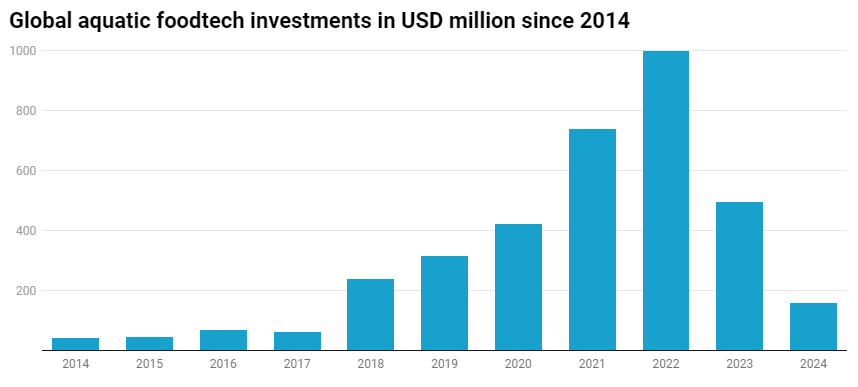

Yet in the first half of 2024, investments in aquatic foodtech startups — technologies for wild-caught fisheries, aquaculture, and seafood alternatives — reached only $150 million across 18 deals, a 40% reduction in investment compared to the first half of 2023.

While it might be too soon to declare 2024 a down year, and might not seem newsworthy given the overall bearish venture capital market in agrifoodtech and beyond, it’s worth noting that aquatic food tech fared much better than most agrifoodtech categories last year, raising nearly $500 million, some 17% more than it did in 2020. Aquatic food tech funding levels were even more impressive in 2022 when startups in the category raised $1 billion in 2022, a whopping 136% more than in 2020.

Aquatic foodtech refers to the technologies targeting all the industries and processes involved in the supply chain of foods farmed or grown in water and their alternatives. This includes the capture and farming of fish, seafood, shellfish and algae, as well as novel foods that replicate those categories via plant-based, cultured or fermented alternatives.

2020 is largely seen as an important comparison year; the year before venture capital valuations went wild and reached record-breaking fever in 2021, it’s seen as a reversion to the mean. If funding levels are around the same level they were in 2020, many commentators believe the picture isn’t too bleak.

The market for aquatic food tech is growing, particularly fish farming: global fisheries and aquaculture production surged to 223.2 million tonnes, a 4.4% increase from 2020, according to the 2024 edition of The State of World Fisheries and Aquaculture (SOFIA). According to that report, which calls this industry a "blue transformation," 2022 was the first year in history when aquaculture surpassed capture fisheries as the main producer of aquatic animals. Global aquaculture production in 2022 reached an unprecedented 130.9 million tonnes, of which 94.4 million tonnes were aquatic animals, 51% percent of total aquatic animal production.

A wide range of technologies are contributing to this "blue transformation," branching across several of AgFunder's agrifoodtech categories and mostly operating upstream, away from the consumer.

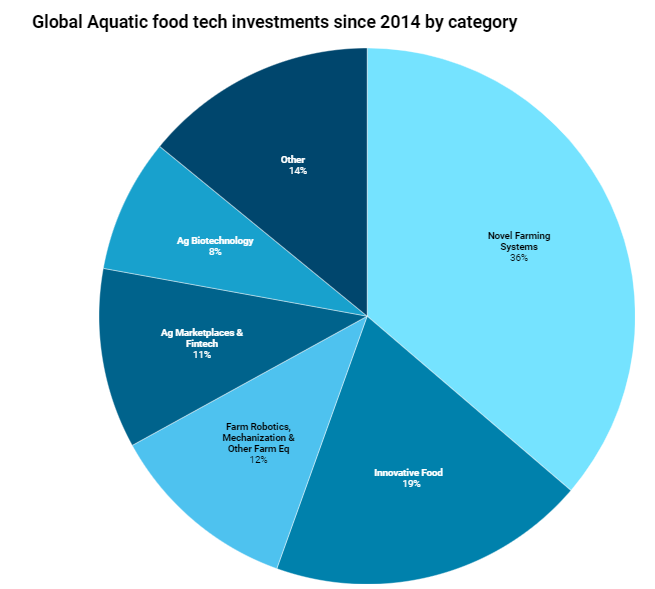

Novel Farming Systems startups focused on aquatic foods, which include high-tech aquaculture growing systems, have raised $1.3 billion across 197 deals in the past 10 years.

The second most funded aquatic foodtech category is Innovative Food, which has raised $689 million in 136 deals since 2014. Farm Robotics, Mechanization & Other Farm Equipment startups raised $413 million across 27 aquatic foodtech deals during the same period, while Ag Marketplaces & Fintech raised $389 million over 54 deals, Ag Biotechnology $289 million with 91 deals, and Farm Management Software, Sensing & IoT raised $251 million with 114 deals.

To get a better idea of the range of technologies and innovations involved in transforming the future of aquatic food tech, let’s take a quick look at some of the most recent deals in each of the above categories

LAXEY is an Icelandic salmon farming company specialized in sustainable land-based aquaculture building a land-based farm in the Westman Islands aiming to produce 32,000 tonnes of atlantic salmon per year. The company raised $42.5 million in April and then $6.5 million in July 2024, with two late-stage rounds that jointly reached $49 million.

Agriloops is a French startup promising to reinvent aquaculture to generate eco-friendly products that are healthier and tastier by designing an aquaponic farm in salt water. The company raised $14 million via a series A round in February 2024.

The Aquacultural Research Corporation specializes in aquaculture research and innovation, pioneering solutions to coastal challenges and educating shellfish growers. Founded in 1960 and headquarterd in Dennis, Massachusetts, it operates as a wholesaler of quahogs and oysters throughout the U.S. The company raised $ 1.2 million via a seed deal in January 2024.

BlueNalu is an American cellular aquaculture company aiming to satisfy the global appetite for seafood in a fresh and humane way by offering consumers seafood products that support the sustainability and diversity of the oceans. The startup raised $33.5 million via a B stage funding round in October 2023.

Israel-based Wanda Fish Technologies is a cell-cultured seafood startup that offers cultivated fish filets by growing fat and muscle cells in a bioreactor using an animal-free growth media. The startup raised $7 million in October 2023 via a seed round deal.

Konscious Foods is a Canadian company offering a range of plant-based seafood for restaurants, caterers, cafeterias, and other commercial kitchens. It raised $19.6 million via a seed round in August 2023.

EFishery is an Indonesian aquaculture technology startup building solutions to help fish and shrimp farmers grow their businesses sustainably. The company raised &30 million in May 2024 via debt funding, after raising $200 million via two D series deals in 2023.

Poseidon Ocean Systems is a Canadian company engaging in aquaculture infrastructure design, development, supply, and installation. It raised $20.7 million in March 2024 via a B series round.

Remora Robotics is a Norwegian technology firm that specializes on aquaculture robotics. It raised $2.8 million via a seed round in August 2023.

Captain Fresh is an Indian freshwater-fish-and-seafood B2B supply chain platform leveraging technology to deliver fast harvest-to-retail solutions. The company focuses on aggregating the fragmented retail demand across the country and linking them to the small fishermen and farmers throughout the Indian coast. It raised $25 million via C-stage funding in January 2024, after raising another C round worth $20 million in 2023.

Juhudi Kilimo in a Kenyan company providing asset financing, technical assistance, and business training services to smallholder farmers and small-to-medium agro businesses. It offers financing for livestock as well as fish farmingl equipment. The Nairobi-based company raised $4.7 million in January 2024 via debt financing.

Seaqua is a Bangladesh-based company offering financing for small-scale fisheries and aquaculture and leveraging technology to streamline product traceability. It raised $600,000 in seed capital in January 2024.

Meu Pescado is a Brazilian agritechn firm that developed a platform for managing fish and shrimp farms allowing real-time operation monitoring. The company secured a $364.400 seed deal in July 2024.

Minnowtech is a Baltimore-based aquaculture technology company that developed a software imaging platform enabling shrimp farmers to estimate shrimp abundance non-invasively with precision. The American startup raised an undisclosed A round in February 2024.

AquaExchange is an Indian IoT-powered aquaculture tech platform for shrimp and fish farming, using technology to enhance aquaculture yields, mitigate crop risks, and assist farmers in reducing costs. It raised $6 million in January 2024 through a series A round.

Sundew is a Danish biotechnology company providing biological services for the treatment of aquatic pests and diseases. The company raised an undisclosed amount in a B series round in April 2024.

ViAqua Therapeutics is an Israeli company developing drugs and therapeutics for aquaculture. It raised $83 million via a series A round in September 2023.

Gas Infusion Systems is a Canadian company developing aquaculture applications utilzing an oxygen delivery system to enhance fish health throughout their entire life cycle. It raised $1.8 million in June 2023 via an A stage round.

AgFunder News